The Revenue-First Product Bundling Strategy for 2026

Successful bundling offers are rooted in understanding what your customers truly need and value.

Ashley R. Cummings

Jan 08, 2026 · 11 min

Shoppers still want what they’ve always wanted: convenience and consistency.

Ashley R. Cummings

Jan 08, 2026 · 11 min

Ashley is a writer focused on SaaS, ecommerce, and the creator economy, helping brands turn complex ideas into clear, actionable content and sharing practical guidance to help merchants grow.

Today’s shopping journey is a bit bonkers.

A shopper might hear about the SKIMS Fits Everybody bodysuit from a friend, see it again (and again) on TikTok, research sizing and reviews on Google, search Amazon, ask ChatGPT or other chatbots a dozen questions about fit and alternatives, pop into a store to feel the fabric, then pull up the SKIMS site while still in the fitting room to check colors, sign up for SMS, and complete the purchase on their smartphone or mobile device.

… Yes, that was a monster sentence, but that’s the point.

The modern customer journey is a marathon of micro-moments across digital channels, physical locations, and sales channels. Stats show that the average customer shops across at least six touchpoints before buying.

It’s also safe to say that while customers are shopping, they’re not thinking about channels. They’re thinking about… well… buying something they want—whether that happens through online shopping, in-store experiences, or mobile commerce.

Retailers, on the other hand?

The process to provide an awesome buying experience isn’t as relaxed. Behind the scenes, teams are working to meet customer expectations across ecommerce, in-store, and social media, while connecting systems, teams, and customer data in real time.

Let's break down five of the latest omnichannel retail trends to help you prepare for a prosperous 2026.

Just a year ago, product discovery looked very different than it does today. Most purchasing journeys still begin the same way: with an online search. In 2024, 49% of shoppers started their journey on a search engine, a figure that remained largely consistent in 2025 at 44%.

But while the starting point hasn’t changed, what shoppers see next has.

Today, search results look fundamentally different. AI-powered overviews now sit at the top of many results pages, answering questions directly and pushing traditional links further down.

Since launching AI Overviews, Google says there’s been a “profound shift” in how people use Search. Shoppers are asking longer, more complex questions, driven by changing shopping behavior, and receiving AI-driven answers instead of scanning a list of links.

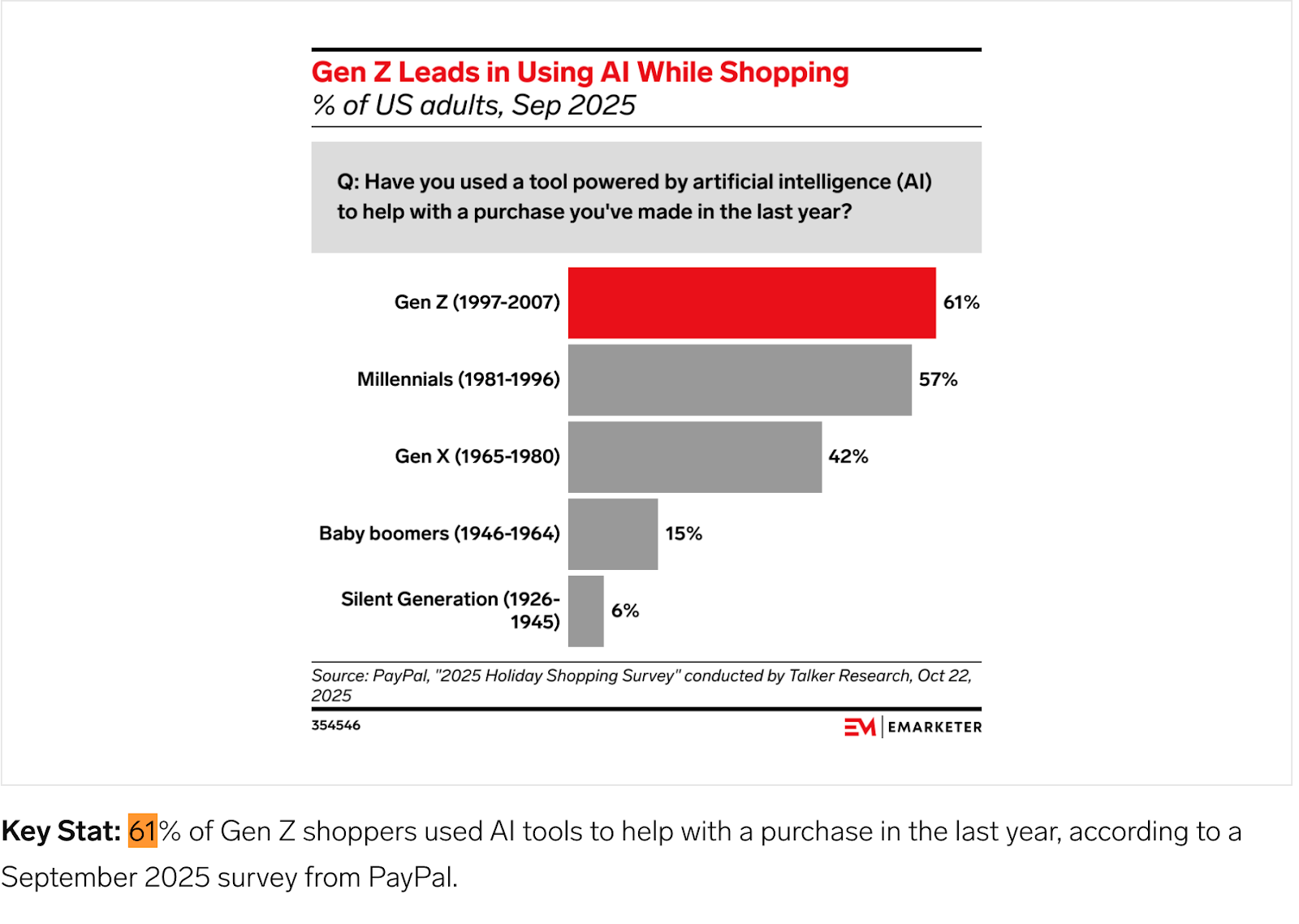

At the same time, a growing group of shoppers is starting product research outside traditional search engines altogether. Tools powered by artificial intelligence, including ChatGPT and Claude, are becoming entry points for discovery, especially for comparison-heavy queries and personalized recommendations, signaling a broader shift in customer behavior and demographics.

Younger shoppers are already leaning into this behavior. In a recent survey, 61% of Gen Z consumers said they’ve used AI tools to help with a purchase in the past year.

As Eli Weiss, VP of Advocacy at Yotpo, puts it: “People aren’t searching the way they used to. They’re asking. When someone types ‘best cleanser for dry skin’ into ChatGPT or Claude, they aren’t scrolling through a dozen links. They’re getting an answer with specific products, reviews, and retailers without ever touching Google or Amazon.”

As Eli Weiss points out in his newsletter, AI-driven discovery is rewarding a very different set of signals than traditional social-first marketing. Brands that win are those with strong customer engagement, credible data, and consistent brand experience across channels.

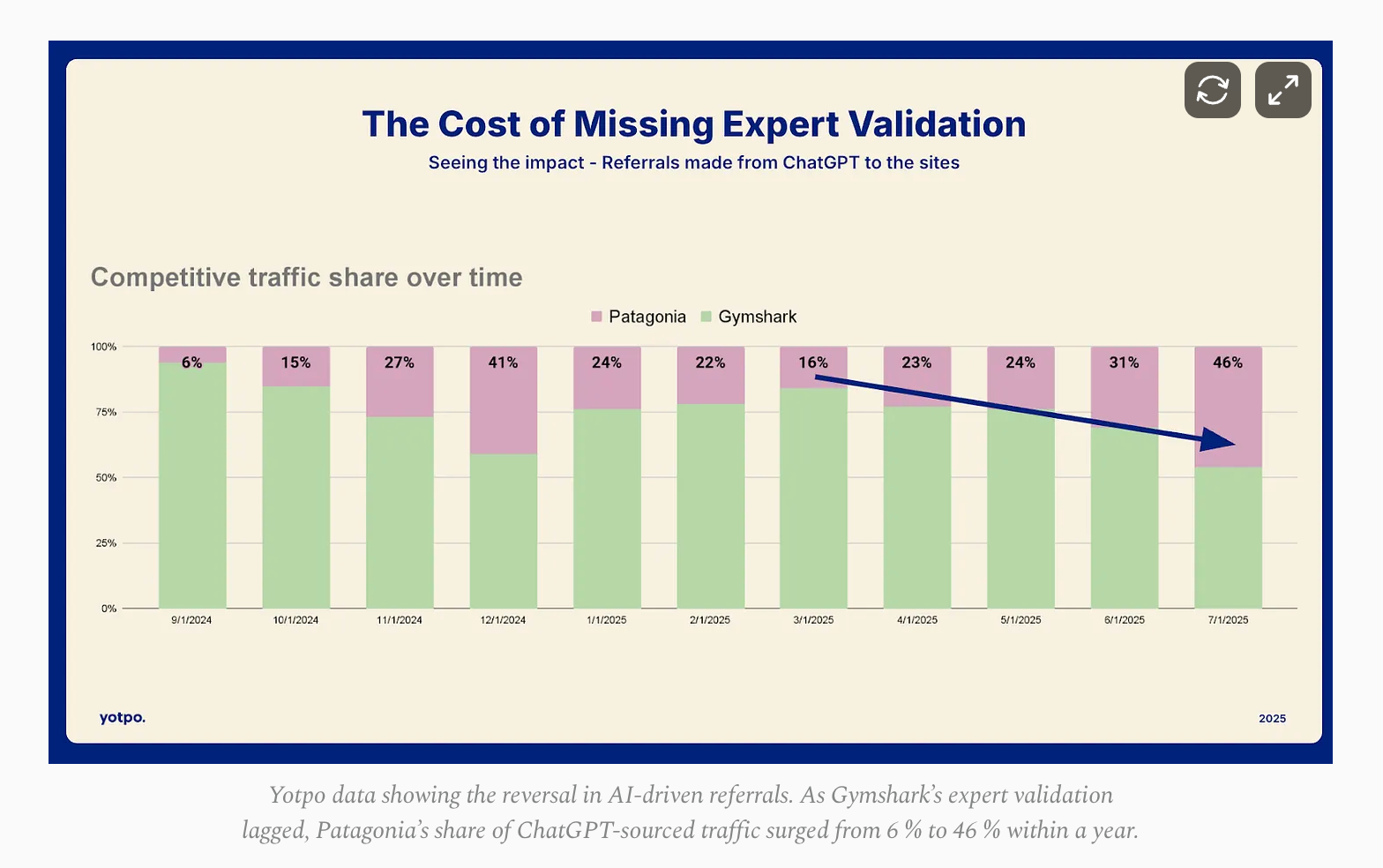

He points to Patagonia and Gymshark as an example.

A few years ago, Gymshark dominated Patagonia. But today, in terms of showing up in AI-search, Patagonia now leads.

According to Yotpo data shared by Weiss, Patagonia appears in roughly 94% of AI-generated recommendations for outdoor clothing and gear. Referral data tells the same story: traffic from ChatGPT to Gymshark’s site dropped from 94% to just over 50% in the past year, while Patagonia climbed from 6% to 46%.

Weiss continues by bringing in analysis from Yotpo CEO Tomer Tagrin, who breaks Patagonia’s advantage down into three factors:

Together, these signals make Patagonia easier for AI models to trust and more likely to recommend.

In short, Brands must integrate AI discoverability into their omnichannel strategy. Weiss gives us 3 strategies to stay ahead:

Search and product discovery aren’t the only places where AI is making a splash in the retail world. Retailers are now using AI to run tighter operations across both online and physical stores.

Instead of scrambling to meet demand after the fact, AI tools predict what customers will want, how much they want, and when. Predictive AI tools help retailers forecast inventory, which leads to leaner inventory, fewer stockouts, and less capital tied up in products that aren’t moving.

This matters because omnichannel retail breaks down quickly when inventory data is out of sync. If online demand spikes while stores are overstocked (or vice versa), customers feel the friction immediately.

But these tools don’t only reduce friction. They actively help reduce costs and improve efficiencies. According to industry analysis, companies that implement AI-powered inventory management have reduced inventory costs by 10–15% while improving supply chain efficiency by 20–25%.

How brands are adapting

Warby Parker is a great example of a brand benefiting from AI. It uses AI forecasting to manage inventory across its ecommerce site and physical retail locations. The system analyzes data from sales, website traffic, and broader demand signals to predict which products—down to specific frames, sizes, and colors—will be needed at each location.

By doing this, the brand improved forecasting accuracy, reduced stockouts, and streamlined pickup options like BOPIS and curbside pickup.

In fact, Warby Parker has reduced stockouts by up to 30%, cut overstocking by 25%, and improved forecasting accuracy by 40%.

The AI system also allows the brand to react faster to changes in demand, adjusting inventory before customers feel the impact.

You don’t need a massive AI overhaul to get value. Start with small, operational wins that compound over time. Here’s how:

We’ve heard it a million times: shoppers (90% of them) want the same experiences everywhere.

When ecommerce and brick-and-mortar stores operate in silos, retailers lose trust, customer loyalty, and revenue. Treating all channels as a single omnichannel shopping ecosystem creates a seamless experience.

Even though creating a seamless customer journey is basically an omnichannel retail commandment, Marco Loguercio explains that some retailers still treat ecommerce and in-store as siloed, competing channels.

Too many companies still treat e-commerce and physical stores as competitors. On The Search Session, @marcologuercio explains why this mindset kills omnichannel opportunities.

— Advanced Web Ranking (@awebranking) December 15, 2025

If a user knows a shop 2 km away has their size in stock, they’ll buy there in minutes. Retailers need… pic.twitter.com/WWuw67rFqO

The best omnichannel retailers prioritize operational consistency across channels. They’re working hard to ensure that whatever a shopper sees (or can do) online works the same way in-store and vice versa.

Allow me to share a personal example of what I mean. I’m headed to the Amazonian jungle with my son next month (woo hoo!). This means my son and I needed some clothes that would protect us from the sun and mosquitoes while also being breathable.

We took an afternoon to shop at a popular outdoor retailer. We found some AWESOME pants in the store for $14.99 (score!), but there was only one pair left in my son’s size. When we went online to buy the exact same pants, they were $59.99.

As a consumer, this is how I feel about that:

So, I did what any smart consumer would do. I searched for a dupe on Amazon—right in the other retailer's store and purchased those instead.

This is the opposite of what retailers want, but it’s solvable if we apply Loguercio’s logic and treat all sales channels as a single channel.

Consistency starts with your systems. When your POS and online storefront share the same logic, it becomes much easier to keep pricing, promotions, and bundles aligned across channels.

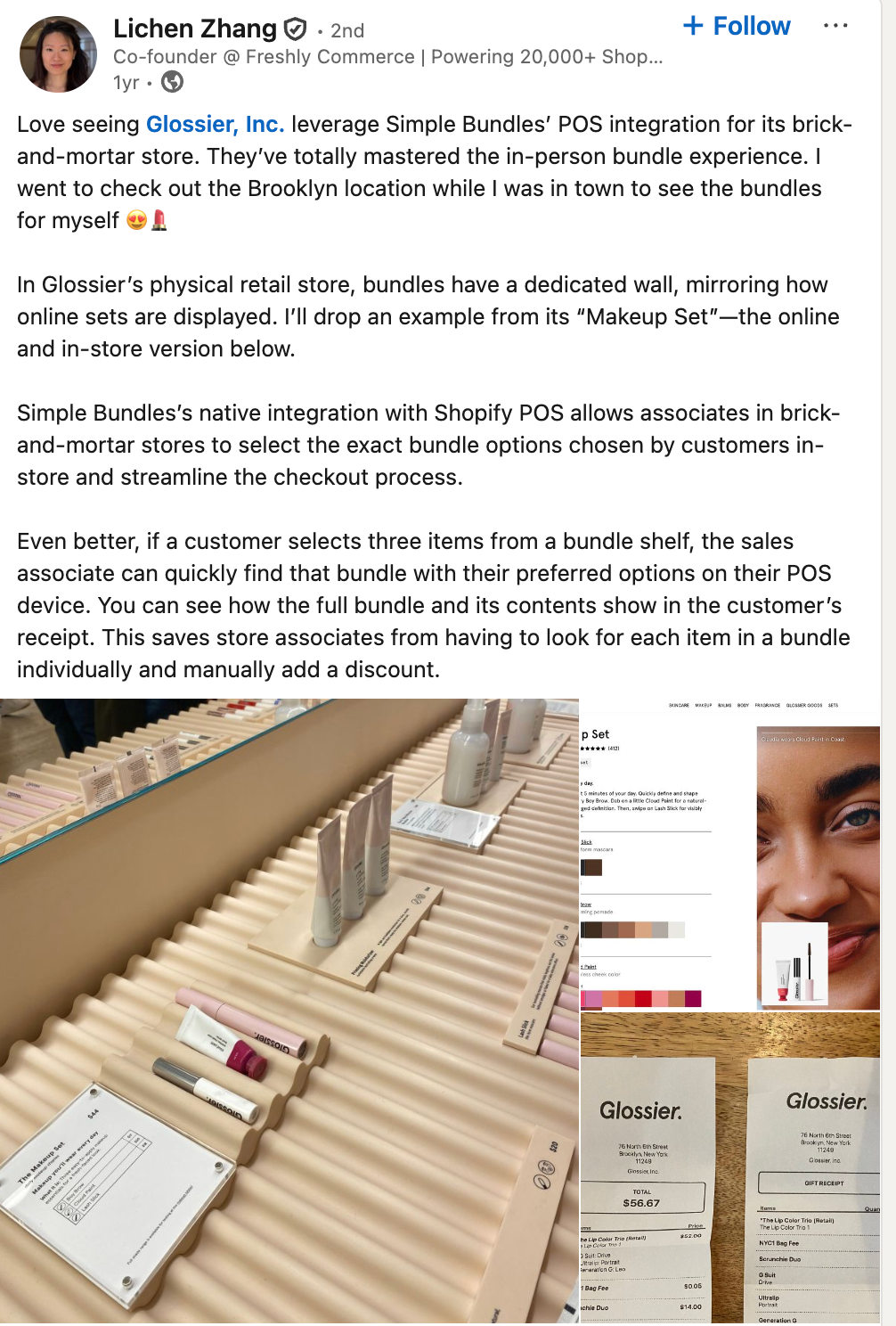

Glossier has mastered the in-person bundle experience. And the best part? It mirrors what shoppers see online.

According to Freshly Commerce’s Co-founder, Lichen Zhang, Glossier’s brick-and-mortar stores feature dedicated bundle displays that mirror the sets customers see online. Its “Makeup Set” bundles use the same products, pricing, and presentation whether shoppers are browsing the website or standing in the store.

Behind the scenes, this works because bundle logic carries through to checkout. With Simple Bundles’ native integration with Shopify POS, store associates can select the same bundle options customers choose in-store and apply them instantly at the register.

If a customer picks three items from a bundle display, the associate can pull up the full bundle—with the correct options—directly on their POS device. The receipt automatically reflects the bundle and its contents, without manually adding each item or calculating discounts.

That consistency saves time for store staff, reduces checkout friction, and delivers exactly what shoppers expect: the same experience, no matter where they buy.

Consistency comes from running the same commerce rules everywhere customers buy online, in-store, and beyond. Here’s what to do:

Retailers have spent the last few years pouring creative energy into building their brands online.

We’ve seen Duo the owl light up TikTok with his antics (oddly, they’re rarely related to language learning). Ryanair’s social team turned budget airline announcements into self-aware comedy sketches. And Princess Polly built a TikTok-native aesthetic so recognizable that its content feels like it came from a single creator, not a brand.

And people are here for it. Consumers regularly and engage with brands on social media. And social commerce revenue is expected to reach $1 trillion globally by 2028.

While social commerce is flooding the retail world, there’s another interesting (and perhaps unexpected) new trend.

Malls (and other physical retail stores) are making a comeback.

But, not in a 1990s kind of way. You’re not going to pop into your favorite retail store and see blank walls and a few cute outfits. You’ll see full-on extensions of a brand’s digital identities, including TikTok aesthetics, membership perks, app-linked fitting rooms, etc.

Now, instead of asking, “How do we sell more in-store?” leading brands are asking, “How does this space deepen connection, build community, and reinforce everything customers already see online?”

While physical stores are built for shopping, they’re also built for interaction.

Skims is a great example of what this looks like when it’s done well.

The brand launched in 2019 as a digital-first powerhouse. Social buzz, inclusive sizing, celebrity-driven campaigns—it all worked. Skims quickly became one of those brands people felt like they already knew before ever buying.

But, instead of staying fully digital, Skims went the other direction.

By the end of 2025, the brand hit a $5 billion valuation and built a growing physical footprint, with 18 stores across the U.S. and two in Mexico, plus a flagship London store on the way. Skims has even said it wants to become a predominantly physical business.

These new locations are perfect examples of extensions of Skim’s online presence. You’ll see the same aesthetic, same tone, same sense of familiarity that customers already get from social and online channels.

And the strategy is working. Skims grew from $500 million in revenue in 2022 to $750 million in 2023, with projections to cross $1 billion in 2025.

Looking to move your online store offline, or do you want to spruce up your physical locations? Here are some things to try:

Yes, retailers are making strides to improve their in-store shopping experiences.

The opposite is also true. Customers now expect digital shopping to be as tactile, social, and personal as being in a physical store.

And many brands are making this happen. How? By investing in experiences that collapse the distance between inspiration and purchase (we’ll talk about these in a minute).

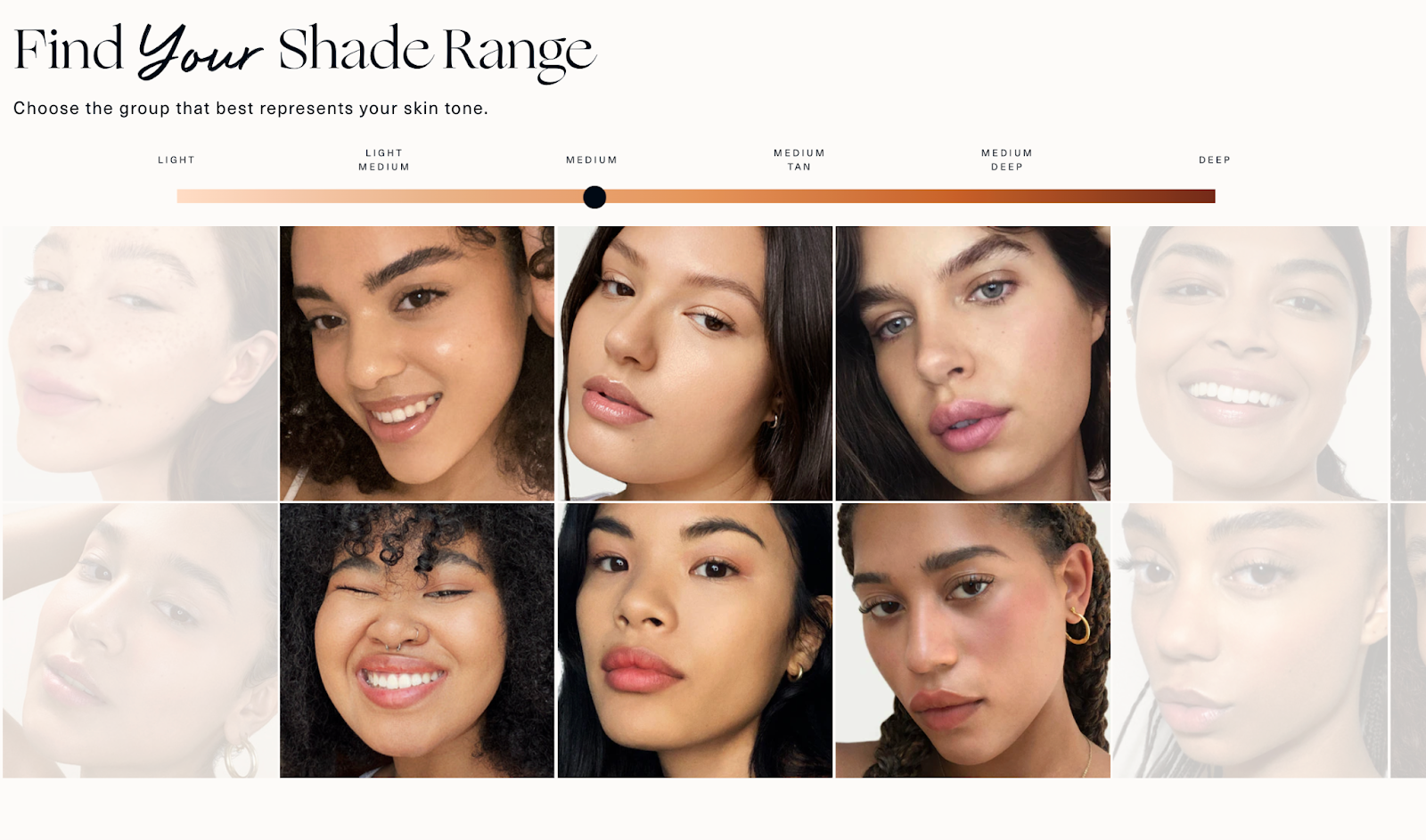

If you’ve ever shopped Rare Beauty online, you’ve seen how easy they make it to choose makeup without stepping into a store.

Here are some of the ways the brand makes this possible:

Here’s how to make your digital experience as tactile as your physical experiences:

If there are two words to sum up the omnichannel retail trends of 2026, it’s these: efficiency and unity. Shoppers still want what they’ve always wanted: convenience and consistency.

Now is the perfect time to align your systems to make the shopping experience effortless for customers.

And investing in your bundle logic is a great place to start.

Get a head start for 2026: Try Simple Bundles for free!