The Must-Have Features to Look for in a Shopify Bundle Builder App

The specific features you should demand from a bundle builder app—and why each one matters.

Tina Donati

Dec 05, 2025 · 20 min

Learn the psychology behind types of discounts, the risks of overusing them, and how to build a discount strategy that boosts sales.

Tina Donati

Dec 05, 2025 · 20 min

Tina Donati is the Head of Marketing at Simple Bundles and has spent the past 7+ years helping Shopify brands streamline their tech stack and unlock growth through smarter product bundling, better UX, and cleaner ops.

Most brands think discounted prices only do one thing: lower the price. But the psychology behind discounting is far more complicated.

A discounted-from-high-price product can actually feel more premium than a product that’s simply priced low from the start.

Why? Because the original price becomes a silent signal.

A high anchor tells shoppers, This is quality. This is special. This is the kind of thing people splurge on. The discount then sweetens the deal by making that level of quality feel accessible.

In other words, the price you cross out matters just as much as the price you keep.

This article breaks down the psychology behind types of discounts, the risks of overusing them, and how to build a discount strategy that boosts sales without eroding your margins or your brand.

Let’s get into it.

Before we dive into discount formats, there’s one thing most brands skip, and it’s the reason so many promotions miss the mark.

To understand what a discount does, you have to understand what a price is.

And in that story, there are three characters that shape every buying decision: the reference price, the reservation price, and the asking price.

Let’s break them down.

A reference price is the mental benchmark shoppers carry around with them, usually without realizing it. It guides almost every pricing judgment they make.

Some items come with a crystal-clear reference price. If you buy the same $3 coffee every morning, you know exactly what it should cost. If it goes up by 75¢, you feel it immediately.

But other categories? The reference price is basically a guess.

Walk into a grocery store and look at clementines. You might know that they’re “usually around a dollar-ish per pound,” but that’s about it. If the price jumps to $2.20, it feels wrong—even if you can’t articulate why. If it drops to $0.25, suddenly clementines become the best decision you've made all week.

That’s the power of the reference price: it’s the compass shoppers use to navigate value, even when the compass is wildly inaccurate.

And sometimes, it works against you. Ever gone from your usual $3 drip coffee to a specialty café and suddenly found yourself staring at an $8 pumpkin-spice-something? Your reference price followed you in the door. And it did not approve.

Brands can’t control a customer’s internal benchmarks… but they can guide them. Five ways marketers shape reference prices without ever touching the product:

Reference prices are powerful, but they’re also fragile. Which means a well-framed discount can shift perception instantly if you set the stage correctly.

If the reference price is what a shopper expects to pay, the reservation price is what they’re willing to pay—their personal ceiling.

This number bends depending on mood, context, motivation, and a dozen other invisible levers. It’s shaped by utility: “Is this worth it to me, right now?”

And utility is both math and emotional.

Maybe the shopper is hungry, tired, busy, or craving the exact thing you're selling. Maybe they have a gift card. Maybe they’ve been thinking about this purchase for months. Maybe they’re shopping from bed at 1 a.m. because insomnia and retail therapy have formed a toxic friendship.

All of that changes their reservation price.

Because so many factors influence it, raising a reservation price directly is almost impossible, but you can expand the perceived value supporting it.

Ways brands subtly increase a customer’s willingness to pay:

The higher the perceived value, the more customers feel justified stretching toward full price—before any price reductions or discount offers enter the picture.

Finally, we get to the number brands actually control: the asking price.

This is the official price tag. And yes, it’s tempting to adjust it whenever you need a boost. But the asking price carries more weight than brands often realize.

Because the moment you publish a price, you’re not just telling customers what something costs. You’re telling them:

A price that’s always lower than everyone else’s might win short-term conversions, but it also signals “budget option,” whether you intend it or not.

A price that’s always discounted eventually becomes meaningless. Customers stop believing the “original” price was ever real.

A price that’s higher than competitors but poorly positioned feels arrogant.

But framed with the right value proposition? It suddenly feels justified.

None of these outcomes are inherently good or bad. They’re simply proof of one truth: Price is never just a number. It’s a message.

Which is why discounts shouldn’t be reactive—they should be intentional. Because every time you change the asking price, you’re rewriting the story your brand is telling.

There’s a reason discount offers remain one of the most reliable levers in commerce: they taps directly into how the human brain makes decisions. The instinctive, feelings-first, dopamine-chasing shoppers who want to believe we found a great deal.

At its core, a discount gives shoppers something precious: a built-in comparison point. $120 might feel expensive. But $120 marked down from $240? Suddenly that same item becomes a steal, and those shoppers feel like loyal customers getting special deals.

This is why brands lean heavily on percentage-based discounts, discount codes, and flash sales. They don’t just lower the cost—they reshape how we perceive the cost. Discounts tell a story in a single line: Here’s what it was… here’s what it is now… look how smart you are for grabbing it.

It’s consumer psychology boiled down to a simple equation: anchor high, sell low, make the customer feel victorious.

A good deal literally lights up the brain. Neuroscientists have tracked it: the moment shoppers realize they’re saving money, the brain releases dopamine, the neurotransmitter responsible for pleasure and reward.

Here’s what’s happening under the hood:

When a discount is framed as exclusive discounts, limited-time offers, or a buy one get one promotion, the emotional payoff is even stronger. Because these discount strategies make them feel limited, unexpected, or cleverly disguised as a “find,” creating a hit of emotional gratification that everyday pricing can’t compete with.

Underneath the emotions sits a stack of cognitive biases quietly steering the shopper toward checkout. Here’s how those biases influence discount behavior:

A classic example? The mattress industry. Those 100-night free trials aren’t about comfort—they’re about the endowment effect. By the time the trial ends, customers already feel like the mattress is theirs. Sending it back would feel like losing something… which circles right back to loss aversion.

For all the psychological power discounts hold, there’s a darker side marketers eventually run into: the slow, quiet way discounts reshape customer expectations.

Discounts can damage customer retention if overused.

If the customer learns that waiting always leads to a lower price, they will.If full price rarely appears, full price stops feeling real.If discounts replace value, customers become bargain chasers rather than repeat customers.

There’s a concept in psychology called effort justification, and it explains a lot about why discounts can backfire, especially in higher-consideration purchases.

The idea is simple: People value things more when they have to work for them.

When a buyer has to:

…they become more emotionally invested in the outcome. Their effort creates ownership. And that ownership becomes commitment.

But when you drop the price too easily, you short-circuit that whole process.

The first time you run a sale, it feels like a growth unlock. The tenth time? It starts to feel like your customers are only showing up when there’s a flashing red price tag.

This is where the long-term cost creeps in: customers recalibrate their internal reference point. The sale price becomes the real price. Full price becomes the “are you serious?” price.

Overuse also encourages:

And once that mental switch flips, it’s incredibly hard to undo.

The following discount types aren’t just tactics, they’re levers that influence behavior, purchase intent, loyalty, and long-term perception.

Let’s walk through each one and what makes it effective.

Percentage and dollar-amount discounts are the oldest tricks in the book, and still the most widely used because they’re easy to understand, easy to communicate, and easy to execute.

But “simple” doesn’t mean “boring.” These discounts tap into anchoring, perceived value, and the shopper’s instinct to compare numbers quickly.

Percentage reductions shine when you’re dealing with higher-priced items. Why? Because humans are terrible at math, but very good at reacting to big numbers.

Percentages create an emotional jolt, especially when the number is 30% or higher. And the best part? Percentages travel well across product categories. They’re recognizable at a glance and require zero explanation.

Percentage-based deals work best for:

Fixed amount discounts, (AKA dollar-off discounts) do the opposite: they work hardest at lower price points. When the price tag is small, the brain can’t “feel” percentages as well.

Fixed discounts win because customers don’t have to calculate. They see the savings instantly. That’s especially powerful for impulse buys, lower-cost consumables, and everyday items.

Dollar-amount promos work best for:

A first-time customer discount is like rolling out a red carpet, but one you can only lay down once. It’s meant to break friction, reduce risk, and give shoppers the final nudge to hit “buy.”

But the mistake most brands make? They use it to acquire customers and forget to follow it with retention strategy.

Without a path forward—email flows, re-engagement, cross-sells, loyalty benefits—your “new customer offer” becomes a revolving door of one-and-done buyers who came for the discount and left for the next one.

When used correctly, though, first-time discounts:

Just remember: if your second purchase rate is low, no discount can save you. First-time offers should be the beginning, not the whole relationship.

Loyalty discounts aren’t really about money—they’re about recognition. They tell customers, “You matter more than someone who just walked in the door.”

Strong loyalty incentives:

This is where tiered programs shine. When shoppers unlock bigger benefits by engaging more deeply (more points, more purchases, higher tiers), your discounts become earned. That makes them feel more valuable and increases retention.

Loyalty discounts work best when:

The secret: make customers feel like insiders, not coupon collectors.

Seasonal discounts work because they align with moments when shoppers naturally want to spend. Back-to-school, Black Friday, summer clearance, holiday gifting—these are cultural triggers.

Customers expect discounts during these windows, which means you can:

And unlike evergreen promotions, seasonal events don’t train customers to delay purchases because the timing is predictable and limited.

Seasonal discounts are especially powerful for brands with:

If discounts had an adrenaline category, flash sales would win. Flash sales create:

A flash sale tells the customer: “You don’t have time to think about this. If you want it, grab it now.”

That emotional velocity is why countdown timers, 24-hour promos, and “only 3 hours left” banners perform so well.

Flash sales are ideal when:

Just don’t run them too often or you’ll accidentally train customers to wait for the next one.

Buy-One-Get-One deals are powerful because they flip the psychology from “spend money” to “get more.” Customers feel like they’re being rewarded simply for participating.

BOGO works well for:

The hidden benefit? BOGO deals increase product usage, which increases the likelihood of reordering.

Bundles can increase AOV, help customers make better purchase decisions, clear inventory, and introduce shoppers to products they wouldn’t buy individually.

They tap into two powerful psychological levers: value perception and decision reduction.

There are two core types:

Within those categories, there are many other bundle types. Here are some common types of bundles, and when they work best:

If you run a Shopify store and want to start bundling without headaches, Simple Bundles is one of the best tools available.

The app lets you build any kind of bundle — from fixed two-product sets to mix-and-match packs or multipacks — without messing up your core inventory or checkout flow.

Bundles created with Simple Bundles stay fully inventory-synced and break down into individual SKUs for fulfillment, which means no overselling or surprise stockouts even if you use 3PL or multiple warehouses.

Volume discounts reward customers for buying more of the same item. They’re ideal for high-usage categories where repeat purchase is guaranteed.

Think:

The appeal is simple: customers save more when they buy more. And brands win because they secure larger upfront orders and reduce fulfillment costs.

Tiered discounts introduce gamification into shopping. The more the customer spends, the better the deal becomes.

Examples:

Shoppers naturally anchor themselves to the next tier. “I’m only $18 away from the higher discount” is one of the most profitable sentences in ecommerce.

Threshold discounts trigger once a shopper hits a specific cart minimum—usually applied to the entire order. These are different than tiered discounts because the offer can change depending on the threshold the customer meets.

Examples:

And customers love them because they feel like “earning” the deal.

If there’s one pricing debate that shows up in every marketing team’s Slack channel, it’s this one: Should we frame the discount as dollars off or percent off?

Here’s how to think about it: Shoppers respond to the biggest-looking number—no matter what format it comes in.

If you tell someone they’re getting 30% off, that feels juicy. If you tell them they’re getting $2 off, that feels… fine. Technically correct. Mathematically identical if the product is $6.67. But emotionally? Not even close.

Our brains gravitate toward the number that looks bigger, even if the actual savings are the same. That’s why we instinctively value “20% off” more than “$10 off” when the product is expensive, but flip the preference entirely when the product is cheap.

It's also why:

You could tell someone, “It’s $800 off,” and suddenly the deal snaps into focus. Same savings. Different framing. Massive difference in perception.

We’re not wired to do fast math. We’re wired to react to what feels meaningful.

Both formats work. But neither works universally.

Here’s how to use discounts intelligently, without falling into the trap of training customers to never pay full price again.

If you don’t believe your full price is justified, your customer won’t either.

Discounts become dangerous when they’re used to mask insecurity.

Customers can feel when a brand is discounting out of panic versus purpose. When a price is anchored in real value—quality, craftsmanship, results, experience—discounts become bonuses.

When you stand confidently behind your price:

If the full price feels shaky, no discount will save you. If the full price feels fair, even a small discount becomes persuasive.

Before you ever offer money off, the buyer needs to care about what you’re selling. That only happens when they’ve invested some cognitive effort—when they’ve imagined the outcome, pictured the benefit, or evaluated the product’s role in their life.

In other words: Let them do the thinking first.

When customers…

…they become emotionally invested. And investment changes everything.

Once they’ve built a case in their own minds, even a small discount feels like a win. It’s the finishing push, not the entire reason for the purchase.

But if you offer a discount upfront?

They don’t have to justify anything. They don’t get the satisfaction of “earning” the savings. And the discount loses emotional meaning.

Effort creates buy-in. Buy-in makes discounts feel powerful.

One of the biggest discounting mistakes brands make is running promotions so often that they become white noise. When customers know a sale is always around the corner, they wait. And wait. And wait.

Predictability solves that.

When discounts are expected but rare, they become exciting instead of expected.

Examples that work:

Predictable infrequency creates a few powerful outcomes:

Consistency teaches your customers how to behave. Give them stability and they won’t go hunting for discounts elsewhere.

Blanket discounts look easy, but they’re margin killers. Smart discounting is designed for specific types of customers at specific moments.

Discounts should reward:

Segmentation does two important things:

Everyone shouldn’t get the same deal because everyone isn’t the same customer.

You can make this happen by pairing discounts with moments of value, like:

This reframes the discount as a celebration or reward, not a last-ditch attempt to move product. It signals to customers: “Something exciting is happening. You’re invited.”

Pairing price cuts with narrative moments increases perceived value and avoids devaluing the brand. It also gives customers a reason to believe in the offer.

Sometimes the best discount is… not a discount.

Not all incentives require lowering your price. Plenty of value-driven benefits feel just as rewarding without slicing into your margin.

Alternatives that still deliver “wow”:

These give customers a sense of getting more without cheapening the product.

The real goal isn’t to lower the price—it’s to increase the perceived value. And sometimes the best way to do that is to add, not subtract.

The smartest brands layer different types of incentives together: bundle pricing plus percentages, loyalty rewards plus early access, flash sales plus thresholds.

Here are a few examples that show how different discount structures can work in the wild—and what you can borrow for your own playbook.

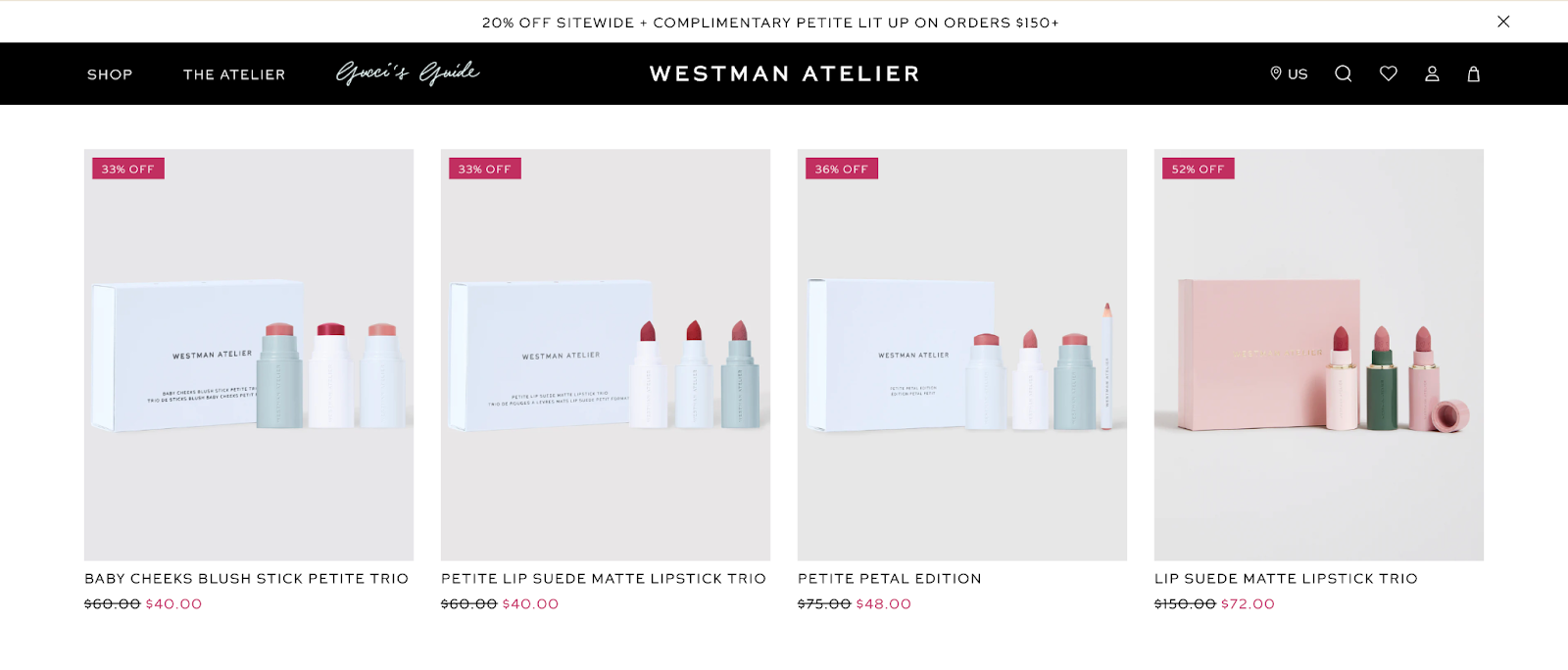

Westman Atelier’s gift sets are a clean example of how to combine bundled discounts with a percentage-off incentive.

Instead of simply knocking 20% off a single hero SKU, they used Simple Bundles to:

Why this works:

What you can steal:

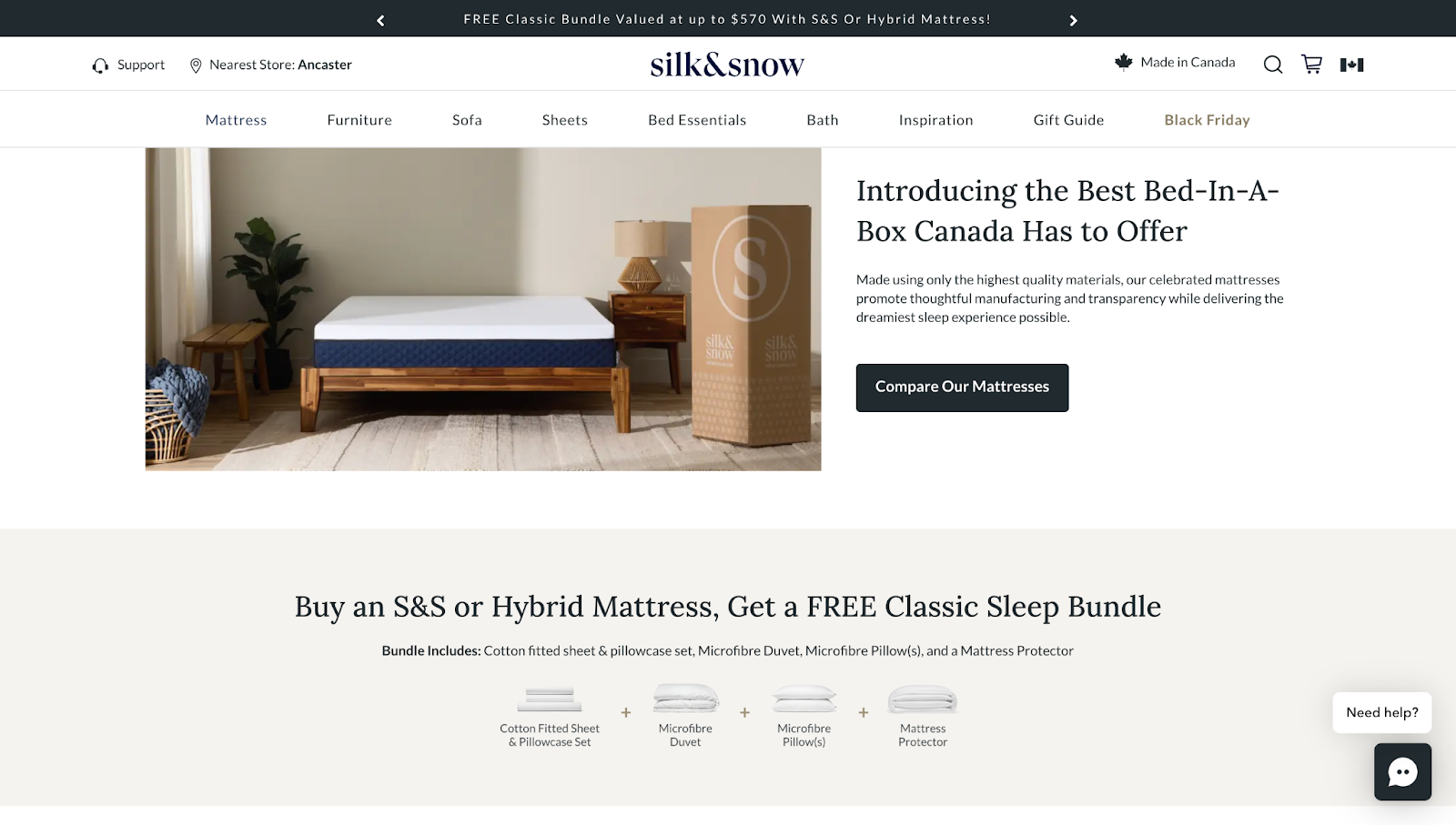

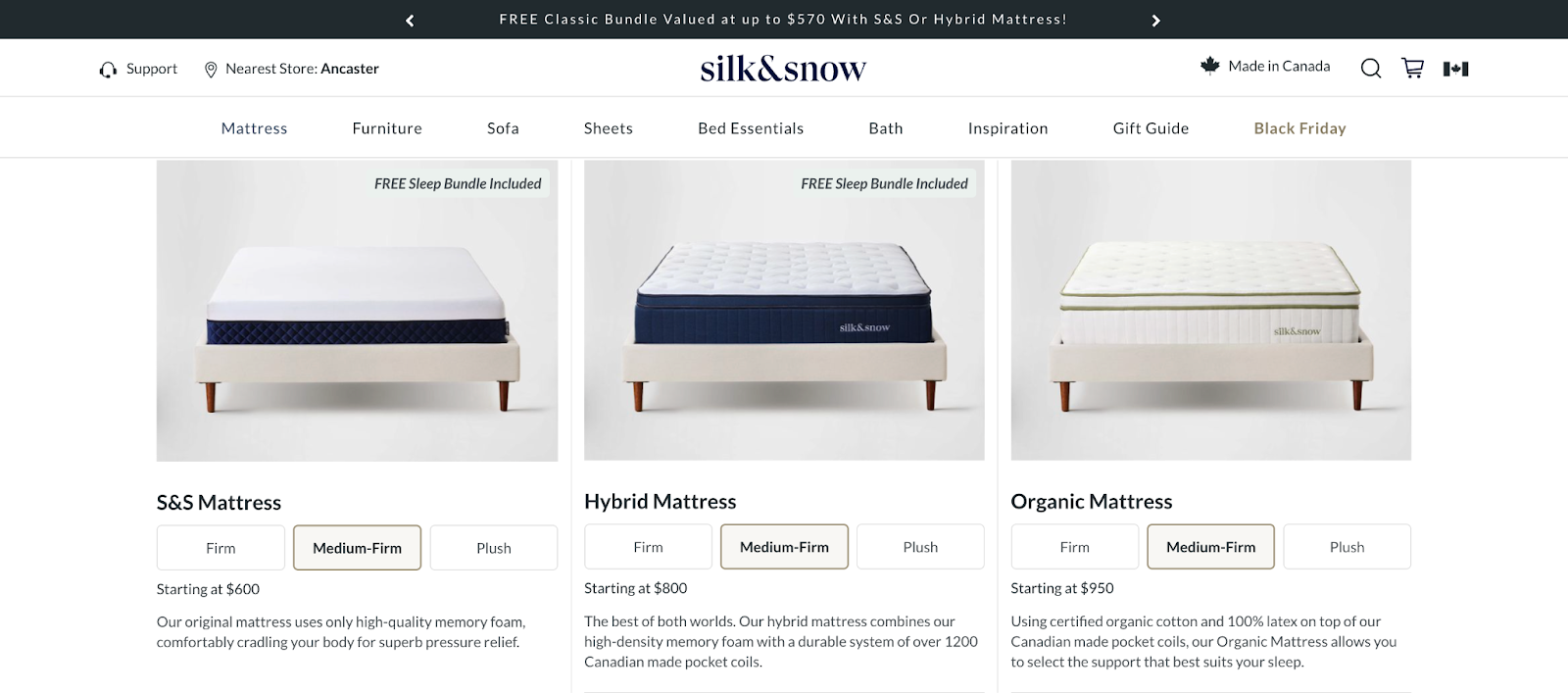

Silk & Snow leans into BOGO-style bundling with their mattresses by offering a “free sleep bundle” with purchase. The smart part isn’t just the giveaway—it’s how they present it.

On their dedicated landing page:

Why this works:

What you can steal:

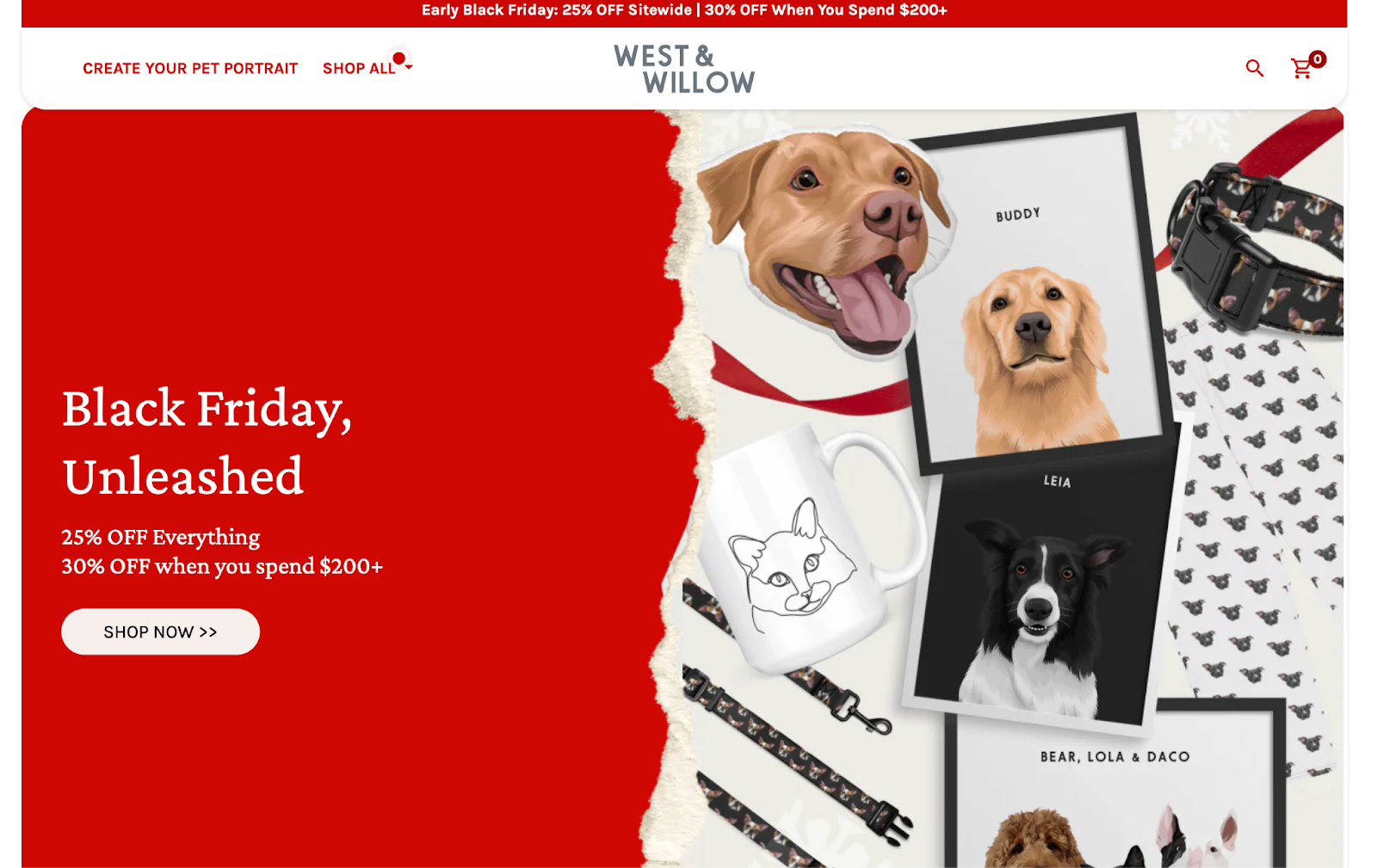

West & Willow uses a tiered discount structure: the more customers add to their cart, the bigger the discount gets. And they don’t bury this—they put it right in the homepage banner, alongside images of their main products.

Why this works:

What you can steal:

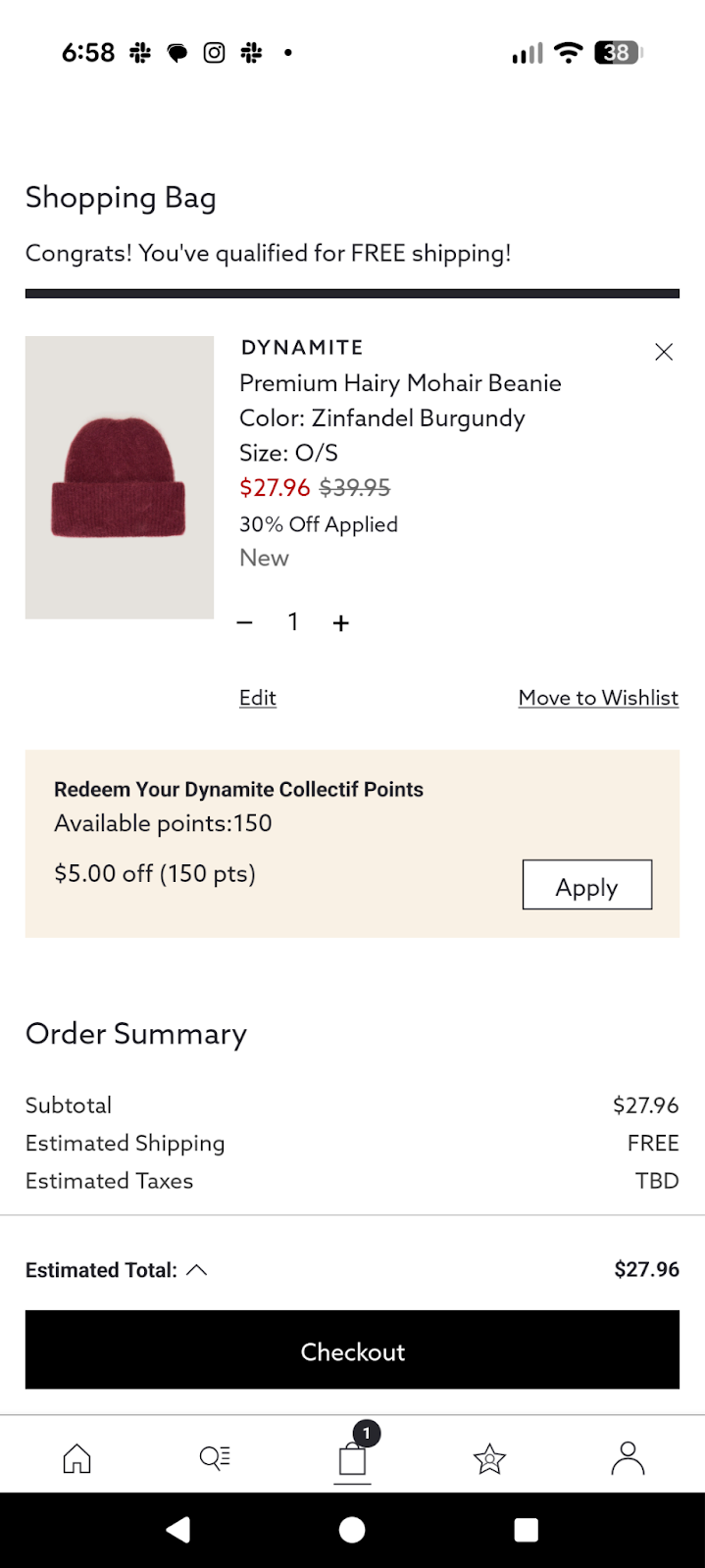

Dynamite’s “Collectif” loyalty program rewards members with points that can be converted into discounts. Nothing new there on its own, but the UX execution is what makes it effective.

On the mobile app or when logged in:

Why this works:

What you can steal:

For its anniversary, Alo launched an “Aloversary” flash sale where everything was 30% off—already a strong hook. But the real play was in how they combined flash sale urgency with loyalty and email strategy.

The structure:

Why this works:

What you can steal:

These examples all share one thing in common: None of the discounts are random.

They’re structured. Intentional. Layered with UX, messaging, and psychology.

There’s nothing inherently wrong with offering discounts. They’re a powerful psychological and economic lever that can boost revenue, bring in new customers, and reward loyalty.

But discounting must be handled with intention.

If bundles are part of your strategy after reading this—and they should be—start by creating a simple two-product bundle or “starter duo.” It’s the fastest, safest way to increase AOV without messing up your margins.

Tools like Simple Bundles make it effortless, so you can test your ideas without slowing down your team.